The 7 Myths of Wealth Management

When the core assumptions are dead wrong, strategy is useless.

Say you were planning a voyage across the world but everyone was still operating under the assumption that it was flat. Could you accurately chart your course and choose your destination?

The false assumption that the world is flat was not perpetuated in malice, but simply a lack of understanding regarding the true nature of the world. Similarly, the false assumptions about wealth that are perpetuated (and even adamantly defended) by academics, compliance officers, regulators, asset managers, and financial advisors are largely unintentional.

There is, however, perhaps something more sinister at work behind the scenes in the wealth management industry. Something in the spiritual realm that is influencing the assumptions and mindset of the entire industry. But that is a subject to explore another day.

There are at least 7 myths that are exceedingly common in the wealth management industry. They are so embedded into industry and engrained in our mindsets that they can hard to spot - like a piece of furniture that's been there so long we don't even see it anymore.

That's the thing about having a false assumption, right? It's hard to spot because it's mixed in with all of your other beliefs and assumptions, most of which are accurate. Let's shine light on them to ensure our ability to skillfully navigate the choices that are ahead (without spending too much time regretting whatever happened in the past).

Myth #1: Performance is the ultimate success.

Whether judging the aptitude of a stock picker or the competence of an advisor, it all comes down to performance. A friend once articulated this assumption so clearly, "I like investing because there's a clear scorecard to easily see if you've been successful. Did you beat the S&P500 or not? It's not subjective."

I can see why this definition of success is attractive. Sometimes our overworked minds are so inundated with complexities and nuance that we crave simpler ways of making choices. We like clear, simple frameworks and we like it when things are black-and-white.

We also like to win...to outperform...to strive and attain the best outcomes. We can see it as a confirmation of our ability to make great choices when we see a winning scorecard, a performance report that's all gains and no losses. We can even feel a sense of personal affirmation when our investment choices obtain a desirable outcome. It means we are smart and savvy, right?

The main problem with this approach of performance as success, is that it neglects to consider how profits are generated, insisting instead that they are generated consistently, efficiently, and with the least amount of risk possible.

I believe that the "how" matters very much to God and is part of his definition of success for those who wish to hear the Master say, "Well done, good and faithful servant." This is because, in God's economy, people are more important than profit. High profitability attained by businesses that kill, steal, and destroy his image bearers (such as tobacco, pornography, and abortion) is not truly successful investing.

A wise steward will also be on guard against getting life, identity, or fulfillment out of being a winner or a savvy investor. 1 Tim 16:19 reminds us not to put our hope in wealth, which is uncertain. I would add that our ability to choose winning stocks is also uncertain. If you allow yourself to feel personally validated by your great investing skills after some great outcomes, watch out! Your time of eating humble pie is likely to come, and then who will you be?

Our definition of success must be tied to our faithfulness, not our outcomes. Most things are outside of our control. A successful steward will learn about investing, discern how biblical values apply, pray for wisdom, seek wise counsel, and trust God with the outcomes since He alone is the Provider.

Twin Myths #2 & 3: You should avoid unnecessary risk & the only reason to embrace risk is for higher return.

In my early years as an advisor, I was introduced to an innovative and popular financial planning software. One reason why this particular tool resonated with clients and advisors is that it showed the client how much risk he or she needed to take in order to achieve their goals.

The assumption was that the client should not be encouraged to endure unnecessary risk in their investing if their financial goals were already on track. Instead, the software proposes a portfolio of low-returning, "risk-free" assets (such as Treasuries, CDs, etc.) and only includes an allocation to risk assets, like stocks, if a higher rate of return is required to meet financial shortfalls. The assumption is that an investor would (and should) only endure greater risk for the potential reward of greater financial returns.

The challenge with this narrow, mathematical perspective is that humans take risks for reasons other than returns (in all areas of life). At our best, we embrace risk for the sake of love (not just profit) and as an act of trust, worship, and obedience. Here are a few examples.

- Volunteer firefighters run into burning buildings to save lives.

- Already busy parents with full schedules and tight budgets adopt or foster kids that have been stuck in the system.

- Combat teams rush in to rescue trapped civilians in war.

- Well-paid professionals quit their jobs and move across the world to start non-profits, or use business to serve the poor.

Taking risk for the sake of love is one of the ways people reflect the nature of God as his image bearers, as God is a risk taker. He took a huge risk in sacrificing his only Son to redeem a world that has the free will to reject him. He takes a big risk entrusting the planet to us as his ambassadors when our hearts are not always aligned with his. But they can be. One of the ways we most effectively align our hearts with his is when we align our financial resources with his goals and values.

As stewards, there are many ways in which we can embrace risk fort the sake of sharing God's love with the world around us. We can give generously, embracing the risk of dwindling our own store of wealth. We can invest in impact funds that promote job creation and lift people out of poverty, embracing the risk of a potentially lower return for a portion of our portfolio. We can work in careers, not just based on financial benefit, but based on potential kingdom impact.

Which risks should we embrace then? That depends on the design God has chosen for our lives (Ephesians 2:10) and our willingness to respond to God’s invitation to take risk, even to the point of dying to ourselves, that we might truly live for him.

Myth #4: Financial plans should cover your life expectancy.

I once attended a continuing education course for financial advisors on the topic of aging and life expectancy. The speaker was a researcher, and geriatrician. She highlighted how many scientists believe that because nutrient deficiencies are highly prevalent, appropriate supplementation and an improved diet could reduce much of the consequent risk of chronic disease and premature aging.

She urged the room full of financial advisors to plan for their clients to live at least to age 100 as anything less could result in financial shortfalls in retirement plans. She explained how it would be irresponsible to plan for a shorter life expectancy and send clients into retirement unprepared.

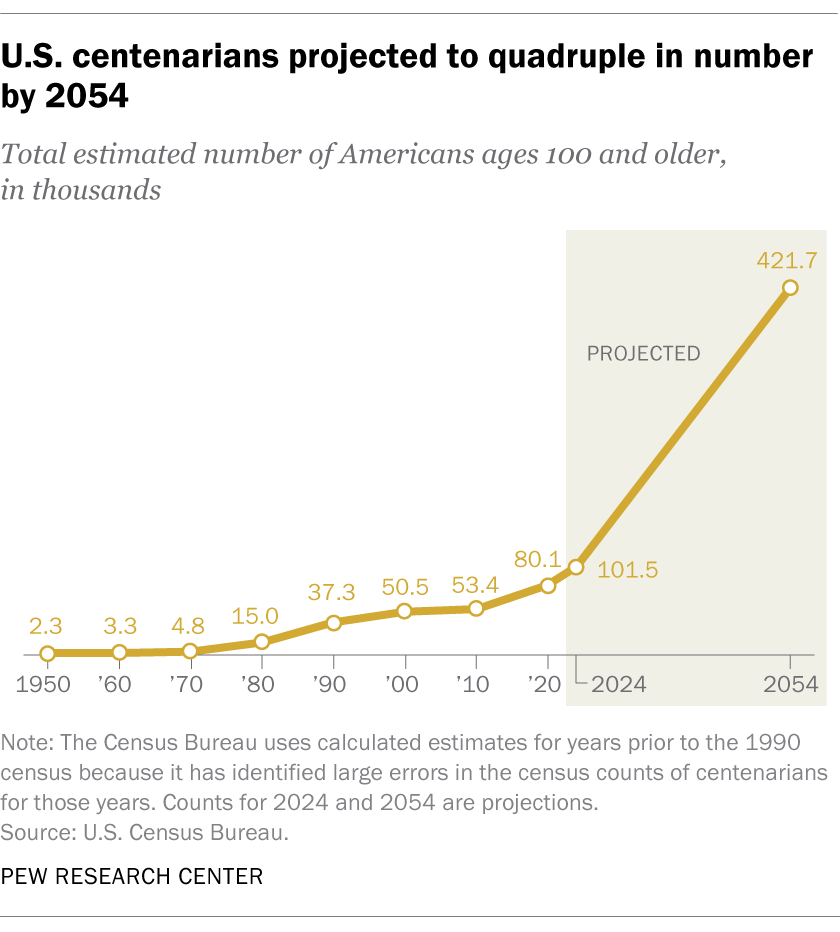

Medical advancements have resulted in a rapidly increasing number of centenarians since around 1970. Progress in this specialized field could mean an even bigger acceleration of this trend in the coming years.

The U.S. Census Bureau estimates that the number of centenarians in the U.S. will quadruple by the year 2054.

Here's the problem with the 100 year planning assumption: our lives on this earth are but a vapor. We are here today and gone tomorrow. Even if we live to age 120, this life is incredibly brief in light of eternity. If we believe that heaven and eternity are real, then we must plan for a much, much longer time horizon.

The smartest approach to stewardship is to use resources in this life in such a way that we maximize our eternal outcomes. Eternity is abstract and hard to wrap our heads around, but it is the greater reality and must be the higher priority. We can and should optimize for eternal outcomes, not just temporal ones!

If we are overly focused on planning for this life, putting our hope in our wealth to keep us in our old age, we'll miss out on the opportunities God sends us to put our trust in him and do impossible things with him.

Let's not make a financial plan to age 100, execute it diligently, only to die with an account full of leftover resources and a heart full of regret, realizing that we never lived.

Myth #5: Once it's gone, it’s gone!

You've likely heard the old adage that you can use your money however you like but once it's gone, it's gone.

Jesus taught something quite different. He said we should store up for ourselves treasure in heaven. It sounds almost heretical, doesn't it? Storing up treasure for ourselves in heaven? Is that right? Treasure for ourselves? It doesn't sound very pious.

It sounds selfish. So we tend to focus on the other part of the teaching, about not storing up treasure on earth. But Jesus issued this statement as an instruction, something he wants us to respond to in faithful obedience, just like all his other commands.

If fear drives us to store up worldly wealth, in lieu of heavenly treasure, we run the risk of dying with fat balance sheets on earth only to discover that we're are one of the least wealthy saints in heaven. There probably isn't poverty in heaven, but I know our hearts' desire on that day will be to cast a lavish, golden crown at the feet of our Lord and Savior, the One who is worthy of it all...and heavenly crowns belong to those with treasure stored up in heaven.

When we give, invest, or spend resources in alignment with the Spirit, especially when we joyfully serve the least of these. The Scriptures tell us that those who give to the poor lend to God. While I've never seen a heavenly rates of return advertised, I have a hunch they are excellent...well above market rate.

As author, Randy Alcorn, reminds us, "You can't take it with you but you can send it on ahead."

Myth #6: You don’t have enough to make much of a difference.

People living in poverty believe the myth, that their small amount of resources isn't enough to count, but so do ultra-high net worth investors! Rich and poor alike have a tendency to see what they have as insignificant compared to the big needs of those around them.

If we operate in scarcity, we lose our potential impact. We miss out on the best part of life and the ones we could have helped miss out too.

Remember the boy with just a few, small loaves of barley bread and a couple of fish. When placed in the hands of Jesus and his disciples, the food was multiplied enough to feed the 5,000. When we bring our little bit to God and trust him with it completely, all things become possible.

Myth #7: Money brings security (not to mention identity, worth, and significance).

Myths #1 - 6 are all in our thinking, but Myth #7 hides deep down in our hearts. It's so good at hiding that if we were just skimming the list, we might be inclined to skip this one as it seems obvious at first glance. Bringing it to the surface will require honest self-assessment.

Do you feel safer when you have a big cash cushion in the bank? I sure do. While I would say I believe we can trust God as the Provider and Protector in all of life's circumstances, deep down, I feel way more comfortable knowing I have a lot of financial margin. But looking for security from money is a recipe for disappointment because money can't give us security. That is a myth.

Wealth can protect us from some risks (like starvation) but it can't protect us from all, or even most risks. Wealthy people get cancer, have car accidents, watch their kids wander away from the truth, experience rejection, etc. Money can't provide security or guarantee the future. We must look to God for help with these things.

Sometimes we can also fall for the myth that having a large amount of wealth gives us identity, worth, or significance. Here's a quick way to check and see if this myth might be hiding in your subconscious.

Imagine many of your friends and family had gathered at the same restaurant to share a meal with you and they were all waiting for your arrival. Would you feel like a different version of yourself if you pulled into the parking lot in a new Corvette? What if you pulled up in an old, rusty clunker with a broken headlight? Would the way you feel about yourself change? Would you feel the need to explain why you were driving such a vehicle?

We are all prone to caring a little too much what other people think of us, desiring their approval, admiration, acceptance, or applause. Money seems like a solution to this desire as it's easy to impress many people with fancy things.

I noticed this when my husband and I treated ourselves and each other to our red Ford Mustang. We bought it to celebrate and have a little fun after a particularly stressful season of life. It actually isn't a very expensive car (less expensive than our minivan), but it is flashy and fun, and therefore, people assume it is very valuable.

It's been eye-opening how many people (random strangers or friends) express their approval of our car or decide to have conversations with us because of our car. Did the car make us more valuable? Of course not. Did we have to work through that in our hearts? Absolutely. Now that we have, we can use the car as a fishing lure to spark conversations with people we would otherwise not meet and look for ways to express the love of God to them.

Our hearts need frequent reminders of the truth: God is Provider and Protector! He alone is the source of our identity and worth!

Myth #8: It’s all about you.

Of all the myths we must address, this one is the most dangerous and the most widely adopted, and the most defended. It's at the core of everything.

Imagine you've just engaged a financial planner to help you create a plan for how to accomplish your goals and optimize your resources. After the initial onboarding and intake information is obtained about your circumstances, the next question your planner will ask is, "What are your financial goals?"

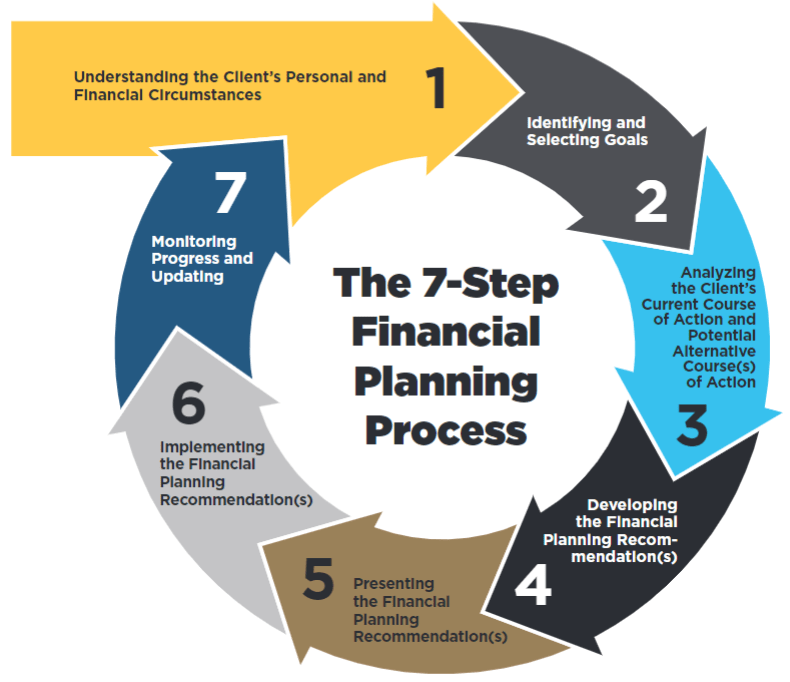

This is generally logical since it's impossible to pinpoint the appropriate strategies without knowing the desired outcomes. "Identifying and Selecting Goals" is even stated as Step 2 in the Certified Financial Planner Board's 7-Step Financial Planning Process, which all CFP professionals are meant to follow.

In wealth management, it's especially easy to believe that it's all about the client achieving what they want. The trouble with this perspective is that the Bible teaches us that all the wealth belongs to God and we are managers on his behalf.

Let me introduce you to a fictitious character, Jill. She is the trustee of a trust her late brother established for the benefit of his minor children. She took distributions from the trust she managed over the course of several years to fund all of her most important financial goals: a modest home, her kids' education, health care, basic retirement needs, etc. Jill is now being sued by her niece and nephew, the beneficiaries of the trust. The problem was not that her financial goals were ostentatious, but that she didn't use the resources to support the goals of the rightful owners.

Can the same happen to us if we start our financial planning with our own goals in mind and forget that we are managers on someone else's behalf.

In our wealth management firm, Wealth Squared, our team explains to clients that we are here to serve, guide, and care for them by partnering with them to pursue God's plan for their lives. At the beginning, we have no idea what the plan will look like.

We still use financial planning rules of thumb and software projections as data points to inform the client as they prepare to make financial decisions. But each time a client walks through the process of identifying their true, God-honoring priorities and goals, we have found that their plan looks different than anyone else's.

At times, it can be difficult to know what God's plan is and how to apply biblical principles in the context of each person's unique circumstances. In fact, learning how to discern God's plans and purposes for our lives is a skill we build over time. But it is a skill best built by practicing in in the training grounds of stewardship.

By taking additional steps to help our clients clarify and document what they believe God would have them do, and encouraging them to pray over their goals and choices, we hope to help them use the wealth God has entrusted to them in a way that aligns with His goals. We believe seeking God's plan leads to a life that is rich with meaning and purpose. It keeps us connected with God himself, the true Source, from whom all blessings flow.